Employer final comprehensive offer

November 3, 2020

EMPLOYER FINAL COMPREHENSIVE OFFER TO SETTLE OUTSTANDING

COLLECTIVE BARGAINING ISSUES

WITH THE

PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA

AND

THE TREASURY BOARD OF CANADA

WITH RESPECT TO THE COMPUTER SYSTEMS (CS) GROUP NEGOTIATIONS:

The Employer proposes this comprehensive offer to settle, contingent upon agreeing to the following items:

1. All items agreed to and signed at the Professional Institute of the Public Service of Canada (PIPSC) Common Table (signed May 22, 2019) form part of this offer, as identified in Annex A:

- Clause 17.04 – Maternity allowance

- Clause 17.06 – Parental leave without pay

- Clause 17.07 – Parental allowance

- Clause 17.09 – Leave without pay for the care of immediate family (deletion of Compassionate care leave provisions)

- (new) Clause 17.19 – Caregiving leave

- (new) Clause 17.20 – Domestic violence leave

- Clause 25.07 – Union dues (deletion of clause)

- Clause 29.11 – Leave for labour relations matters (deletion of clause)

- Appendix “E” – Workforce adjustment

- Appendix “J” – Memorandum of Agreement with Respect to Implementation of Union Leave (deletion of appendix)

- (new) Appendix “J” – Memorandum of Understanding Between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada in Respect to Leave for Union Business: Cost Recovery

- Appendix “K” - Memorandum of Agreement on Supporting Employee Wellness

- (new) Appendix “VV” – Memorandum of Agreement Between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada with Respect to Certain Terms and Conditions of Employment for Deemed Royal Canadian Mounted Police Civilian Members

- (new) Appendix “WW” – Memorandum of Understanding between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada with respect to Implementation of the Collective Agreement

- (new) Appendix “XX” – Memorandum of Understanding between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada with respect to Gender Inclusive Language

- (new) Appendix “YY” – Memorandum of Understanding between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada with respect to Workplace Harassment

- (new) Appendix “ZZ” – Memorandum of Understanding between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada with respect to the Common Pay Administration

2. Increase to rates of pay, as identified in Annex B.

3. Duration – three (3) year agreement, expiring on December 21, 2021, as identified in Annex C.

4. Amendments to the following, as identified in Annex D:

- Clause 17.02 – Bereavement leave with pay (Expanded definition of family)

- Clause 17.09 – Leave without pay for the care of immediate family (Expanded definition of family)

- Clause 17.12 – Leave with pay for family-related responsibilities (Expanded definition of family)

- Appendix “F” – Memorandum of Understanding Between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada With Respect to Occupational Group Structure Review and Classification Reform

- Appendix “I” – Memorandum of Agreement Between the Treasury Board and the Professional Institute of the Public Service of Canada With Respect to Contracting Out

5. All items agreed to and signed during negotiations remain agreed to and forms part of this comprehensive offer:

- Changes to references for the Federal Public Sector Labour Relations and Employment Board and Federal Public Sector Labour Relations Act (various articles)

- Replace references to “cash” with references to “payment” (various articles)

- Clause 15.03 – Vacation leave – modifications to provisions:

For the purpose of clause 15.02 only, all service within the public service, whether continuous or discontinuous, shall count toward vacation leave. except where a person who, on leaving the public service, takes or has taken severance pay. However, the above exception shall not apply to an employee who receives severance pay on lay-off and is reappointed to the public service within one (1) year following the date of lay-off. For greater certainty, severance payments taken under Article 19.05 to 19.08 of Appendix H, or similar provisions in other collective agreements, do not reduce the calculation of service for persons who have not yet left the public service.

- Clause 17.17 and 17.18 – Volunteer leave and Personal leave (deletion of transitional provisions)

- Clause 27.03 – Information (deletion of clause)

- Appendix “G” – Memorandum of Understanding: Shared Services Canada (deletion of appendix)

6. Implementation of the provisions for Article 17.06 – Parental Leave without pay will be in effect as of the date of signature of the collective agreement.

7. Provided that the Professional Institute of the Public Service of Canada confirms in writing to the Employer that ratification of the tentative agreement by the CS group was successful on or before June 1, 2021, article 3 of the Appendix “NEW” – Memorandum of Understanding between the Treasury Board of Canada and the Institute with respect to the Implementation of the Collective Agreement will be amended as follows:

- References to “non-pensionable amount of four hundred dollars ($400)” will be replaced “non-pensionable amount of five hundred dollars ($500)” and the cap of 9 payments/$450 for late implementation will be removed.

8. The Employer and the Professional Institute of the Public Service of Canada agree to withdraw all other outstanding items.

9. Unless otherwise agreed between the parties during negotiations, existing provisions and appendices in the collective agreement are renewed.

ANNEX A

ITEMS AGREED TO AND SIGNED AT THE PIPSC COMMON TABLE

CLAUSE 17.04

MATERNITY ALLOWANCE

17.04 Maternity allowance

a. An employee who has been granted maternity leave without pay shall be paid a maternity allowance in accordance with the terms of the Supplemental Unemployment Benefit (SUB) Plan described in paragraph (c) to (i), provided that she:

i. has completed six (6) months of continuous employment before the commencement of her maternity leave without pay,

ii. provides the Employer with proof that she has applied for and is in receipt of maternity benefits under the Employment Insurance or the Québec Parental Insurance Plan in respect of insurable employment with the Employer, and

iii. has signed an agreement with the Employer stating that:

A. she will return to work within the federal public administration, as specified in Schedule I, Schedule IV or Schedule V of the Financial Administration Act, on the expiry date of her maternity leave without pay unless the return to work date is modified by the approval of another form of leave;

B. following her return to work, as described in section (A), she will work for a period equal to the period she was in receipt of maternity allowance;

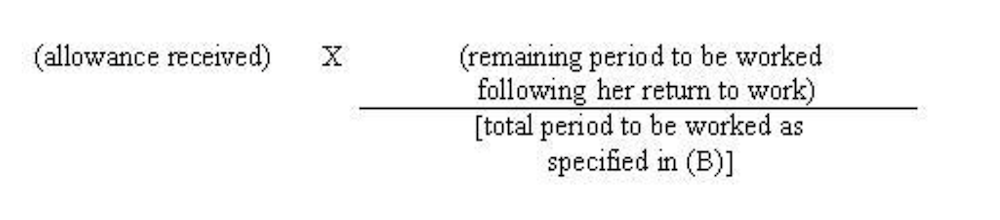

C. should she fail to return to work in accordance with section (A), or should she return to work but fail to work for the total period specified in section (B), for reasons other than death, lay-off, early termination due to lack of work or discontinuance of a function of a specified period of employment that would have been sufficient to meet the obligations specified in section (B), or having become disabled as defined in the Public Service Superannuation Act, she will be indebted to the Employer for an amount determined as follows:

however, an employee whose specified period of employment expired and who is rehired within the federal public administration as described in section (A), in any portion of the core public administration as specified in the Public Service Labour Relations Act within a period of ninety (90) days or less is not indebted for the amount if her new period of employment is sufficient to meet the obligations specified in section (B).

b. For the purpose of sections (a)(iii)(B), and (C), periods of leave with pay shall count as time worked. Periods of leave without pay during the employee’s return to work will not be counted as time worked but shall interrupt the period referred to in section (a)(iii)(B), without activating the recovery provisions described in section (a)(iii)(C).

CLAUSE 17.06

PARENTAL LEAVE WITHOUT PAY

17.06. Parental leave without pay

a. Where an employee has or will have the actual care and custody of a new-born child (including the new-born child of a common-law partner), the employee shall, upon request, be granted parental leave without pay for either:

a single period of up to thirty-seven (37) consecutive weeks in the fifty-two (52) week period (standard option),

or

a single period of up to sixty-three (63) consecutive weeks in the seventy-eight (78) week period (extended option),

beginning on the day on which the child is born or the day on which the child comes into the employee’s care.

b. Where an employee commences legal proceedings under the laws of a province to adopt a child or obtains an order under the laws of a province for the adoption of a child, the employee shall, upon request, be granted parental leave without pay for either:

i. a single period of up to thirty-seven (37) consecutive weeks in the fifty-two week (52) period (standard option),

or

ii. a single period of up to sixty-three (63) consecutive weeks in the seventy-eight (78) week period (extended option),

beginning on the day on which the child comes into the employee’s care.

c. Notwithstanding paragraphs (a) and (b) above, at the request of an employee and at the discretion of the Employer, the leave referred to in paragraphs (a) and (b) above may be taken in two periods.

d. Notwithstanding paragraphs (a) and (b):

i. where the employee’s child is hospitalized within the period defined in the above paragraphs, and the employee has not yet proceeded on parental leave without pay, or

ii. where the employee has proceeded on parental leave without pay and then returns to work for all or part of the period while his or her child is hospitalized, the period of parental leave without pay specified in the original leave request may be extended by a period equal to that portion of the period of the child’s hospitalization while the employee was not on parental leave. However, the extension shall end not later than one hundred and four (104) weeks after the day on which the child comes into the employee’s care.

e. An employee who intends to request parental leave without pay shall notify the Employer at least four (4) weeks before the commencement date of such leave.

f. The Employer may:

i. defer the commencement of parental leave without pay at the request of the employee;

ii. grant the employee parental leave without pay with less than four (4) weeks’ notice;

iii. require an employee to submit a birth certificate or proof of adoption of the child.

g. Leave granted under this clause shall count for the calculation of “continuous employment” for the purpose of calculating severance pay and “service” for the purpose of calculating vacation leave. Time spent on such leave shall count for pay increment purposes.

CLAUSE 17.07

PARENTAL ALLOWANCE

17.07 Parental allowance

Under the Employment Insurance (EI) benefits plan, parental allowance is payable under two options, either

- Option 1: standard parental benefits, 17.07 paragraphs (c) to (k),

or - Option 2: extended parental benefits, 17.07 paragraphs (l) to (t).

Once an employee elects the standard or extended parental benefits and the weekly benefit top up allowance is set, the decision is irrevocable and shall not be changed should the employee return to work at an earlier date than that originally scheduled.

Under the Québec Parental Insurance Plan (QPIP), parental allowance is payable only under Option 1: standard parental benefits.

Parental Allowance Administration

a. An employee who has been granted parental leave without pay, shall be paid a parental allowance in accordance with the terms of the Supplemental Unemployment Benefit (SUB) Plan described in paragraphs (c) to (i) or (l) to (r), providing he or she:

i. has completed six (6) months of continuous employment before the commencement of parental leave without pay,

ii. provides the Employer with proof that he or she has applied for and is in receipt of parental, paternity or adoption benefits under the Employment Insurance Plan or the Quebec Parental Insurance Plan in respect of insurable employment with the Employer, and

iii. has signed an agreement with the Employer stating that:

A. the employee will return to work within the federal public administration, as specified in Schedule I, Schedule IV or Schedule V of the Financial Administration Act, on the expiry date of his or her parental leave without pay, unless the return to work date is modified by the approval of another form of leave;

B. Following his or her return to work, as described in section (A), the employee will work for a period equal to the period the employee was in receipt of the standard parental allowance in addition to the period of time referred to in section 17.04(a)(iii)(B), if applicable. Where the employee has elected the extended parental allowance, following his or her return to work, as described in section (A), the employee will work for a period equal to sixty percent (60%) of the period the employee was in receipt of the extended parental allowance in addition to the period of time referred to in section 17.04(a)(iii)(B), if applicable.

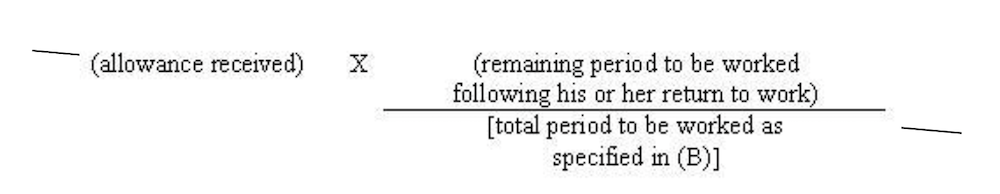

C. should he or she fail to return to work in accordance with section (A) or should he or she return to work but fail to work the total period specified in section (B), for reasons other than death, lay-off, early termination due to lack of work or discontinuance of a function of a specified period of employment that would have been sufficient to meet the obligations specified in section (B), or having become disabled as defined in the Public Service Superannuation Act, he or she will be indebted to the Employer for an amount determined as follows:

|

(allowance received) X |

(remaining period to be worked, as specified in division (B), following his or her return to work) ------------------------------------------------------ [total period to be worked as specified in division (B)] |

however, an employee whose specified period of employment expired and who is rehired within the federal public administration as described in section (A), in any portion of the core public administration as specified in the Federal Public Service Labour Relations Act within a period of ninety (90) days or less is not indebted for the amount if his or her new period of employment is sufficient to meet the obligations specified in section (B).

b. For the purpose of sections (a)(iii)(B), and (C), periods of leave with pay shall count as time worked. Periods of leave without pay during the employee’s return to work will not be counted as time worked but shall interrupt the period referred to in section (a)(iii)(B), without activating the recovery provisions described in section (a)(iii)(C).

Option 1 - Standard Parental Allowance:

c. Parental Allowance payments made in accordance with the SUB Plan will consist of the following:

i. where an employee on parental leave without pay as described in 17.06(a)(i) and (b)(i), has elected to receive Standard Employment Insurance parental benefits and is subject to a waiting period before receiving Employment Insurance parental benefits, ninety-three per cent (93%) of his or her weekly rate of pay (and the recruitment and retention “terminable allowance” if applicable) for each week of the waiting period, less any other monies earned during this period;

ii. for each week the employee receives parental, adoption or paternity benefits, under the Employment Insurance Plan or the Québec Parental Insurance Plan, he or she is eligible to receive the difference between ninety-three per cent (93%) of his or her weekly rate (and the recruitment and retention “terminable allowance” if applicable) and the parental, adoption or paternity benefits, less any other monies earned during this period which may result in a decrease in his or her parental, adoption or paternity benefits to which he or she would have been eligible if no extra monies had been earned during this period;

iii. where an employee has received the full eighteen (18) weeks of maternity benefit and the full thirty-two (32) weeks of parental benefit or has divided the full thirty-two (32) weeks of parental benefits with another employee in receipt of the full five (5) weeks paternity under the Québec Parental Insurance Plan for the same child and either employee thereafter remains on parental leave without pay, she that employee is eligible to receive a further parental allowance for a period of up to two (2) weeks, ninety-three per cent (93%) of her their weekly rate of pay (and the recruitment and retention “terminable allowance” if applicable) for each week, less any other monies earned during this period;

iv. where an employee has divided the full thirty-seven (37) weeks of adoption benefits with another employee under the Québec Parental Insurance Plan for the same child and either employee thereafter remains on parental leave without pay, that employee is eligible to receive a further parental allowance for a period of up to two (2) weeks, ninety-three per cent (93%) of their weekly rate of pay (and the recruitment and retention “terminable allowance” if applicable) for each week, less any other monies earned during this period;

v. where an employee has received the full thirty-five (35) weeks of parental benefit under the Employment Insurance Plan and thereafter remains on parental leave without pay, he or she is eligible to receive a further parental allowance for a period of one (1) week, ninety-three per cent (93%) of his or her weekly rate of pay (and the recruitment and retention “terminable allowance” if applicable) for each the week, less any other monies earned during this period, unless said employee has already received the one (1) week of allowance contained in 17.04(c)(iii) for the same child.

vi. where an employee has divided the full forty (40) weeks of parental benefits with another employee under the Employment Insurance Plan for the same child and either employee thereafter remains on parental leave without pay, that employee is eligible to receive a further parental allowance for a period of one (1) week, ninety-three per cent (93%) of their weekly rate of pay (and the recruitment and retention “terminable allowance” if applicable) for each week, less any other monies earned during this period, unless said employee has already received the one (1) week of allowance contained in 17.04(c)(iii) and 17.07(c)(v) for the same child;

d. At the employee’s request, the payment referred to in subparagraph 17.07(c)(i) will be estimated and advanced to the employee. Adjustments will be made once the employee provides proof of receipt of Employment Insurance Plan or Québec Parental Insurance Plan parental benefits.

e. The parental allowance to which an employee is entitled is limited to that provided in paragraph (c) and an employee will not be reimbursed for any amount that he or she is required to repay pursuant to the Employment Insurance Act or the Act Respecting Parental Insurance Parental Insurance Act in Quebec.

f. The weekly rate of pay referred to in paragraph (c) shall be:

for a full-time employee, the employee’s weekly rate of pay on the day immediately preceding the commencement of maternity or parental leave without pay;

for an employee who has been employed on a part-time or on a combined full-time and part-time basis during the six (6) month period preceding the commencement of maternity or parental leave without pay, the rate obtained by multiplying the weekly rate of pay in subparagraph (i) by the fraction obtained by dividing the employee’s straight time earnings by the straight time earnings the employee would have earned working full-time during such period.

g. The weekly rate of pay referred to in paragraph (f) shall be the rate (and the recruitment and retention “terminable allowance” if applicable) to which the employee is entitled for the substantive level to which he or she is appointed.

h. Notwithstanding paragraph (g), and subject to subparagraph (f)(ii), if on the day immediately preceding the commencement of parental leave without pay an employee is performing an acting assignment for at least four (4) months, the weekly rate shall be the rate (and the recruitment and retention “terminable allowance” if applicable), the employee was being paid on that day.

i. Where an employee becomes eligible for a pay increment or pay revision while in receipt of the allowance, the allowance shall be adjusted accordingly.

j. Parental allowance payments made under the SUB Plan will neither reduce nor increase an employee’s deferred remuneration or severance pay.

k. The maximum combined, shared, maternity and standard parental allowances payable under this collective agreement shall not exceed fifty-seven two (57 52) weeks for each combined standard maternity and parental leave without pay.

Option 2 - Extended Parental Allowance:

1. Parental Allowance payments made in accordance with the SUB Plan will consist of the following:

i. where an employee on parental leave without pay as described in 17.06(a)(ii) and (b)(ii), has elected to receive extended Employment Insurance parental benefits and is subject to a waiting period before receiving Employment Insurance parental benefits, fifty-five decimal eight per cent (55.8%) of his or her weekly rate of pay (and the recruitment and retention “terminable allowance” if applicable) for the waiting period, less any other monies earned during this period;

ii. for each week the employee receives parental benefits under the Employment Insurance, he or she is eligible to receive the difference between fifty-five decimal eight per cent (55.8%) of his or her weekly rate (and the recruitment and retention “terminable allowance” if applicable) and the parental benefits, less any other monies earned during this period which may result in a decrease in his or her parental benefits to which he or she would have been eligible if no extra monies had been earned during this period;

iii. where an employee has received the full sixty-one (61) weeks of parental benefits under the Employment Insurance and thereafter remains on parental leave without pay, he or she is eligible to receive a further parental allowance for a period of one (1) week, fifty-five decimal eight per cent (55.8%) of his or her weekly rate of pay (and the recruitment and retention “terminable allowance” if applicable) for each week, less any other monies earned during this period, unless said employee has already received the one (1) week of allowance contained in 17.04(c)(iii) for the same child.

iv. where an employee has divided the full sixty-nine (69) weeks of parental benefits with another employee under the Employment Insurance Plan for the same child and either employee thereafter remains on parental leave without pay, that employee is eligible to receive a further parental allowance for a period of one (1) week, fifty-five decimal eight per cent (55.8%) of their weekly rate of pay (and the recruitment and retention “terminable allowance” if applicable) for each week, less any other monies earned during this period, unless said employee has already received the one (1) week of allowance contained in 17.04(c)(iii) for the same child;

m. At the employee’s request, the payment referred to in subparagraph 17.07(l)(i) will be estimated and advanced to the employee. Adjustments will be made once the employee provides proof of receipt of Employment Insurance.

n. The parental allowance to which an employee is entitled is limited to that provided in paragraph (l) and an employee will not be reimbursed for any amount that he or she is required to repay pursuant to the Employment Insurance Act.

o. The weekly rate of pay referred to in paragraphs (l) shall be:

i. for a full-time employee, the employee’s weekly rate of pay on the day immediately preceding the commencement of parental leave without pay;

ii. for an employee who has been employed on a part-time or on a combined full-time and part-time basis during the six (6) month period preceding the commencement of parental leave without pay, the rate obtained by multiplying the weekly rate of pay in subparagraph (i) by the fraction obtained by dividing the employee’s straight time earnings by the straight time earnings the employee would have earned working full-time during such period.

p. The weekly rate of pay referred to in paragraph (l) shall be the rate (and the recruitment and retention “terminable allowance” if applicable) to which the employee is entitled for the substantive level to which he or she is appointed.

q. Notwithstanding paragraph (p), and subject to subparagraph (o)(ii), if on the day immediately preceding the commencement of parental leave without pay an employee is performing an acting assignment for at least four (4) months, the weekly rate shall be the rate (and the recruitment and retention “terminable allowance” if applicable), the employee was being paid on that day.

r. Where an employee becomes eligible for a pay increment or pay revision while in receipt of the allowance, the allowance shall be adjusted accordingly.

s. Parental allowance payments made under the SUB Plan will neither reduce nor increase an employee’s deferred remuneration or severance pay.

t. The maximum combined, shared, maternity and extended parental allowances payable shall not exceed eighty-six (86) weeks for each combined maternity and parental leave without pay.

CLAUSE 17.09

LEAVE WITHOUT PAY FOR THE CARE OF IMMEDIATE FAMILY

Compassionate care leave

f. Notwithstanding paragraphs 17.09 (a) and 17.09 (b) above, an employee who provides the Employer with proof that he or she is in receipt of or awaiting Employment Insurance (EI) Compassionate Care Benefits may be granted leave for periods of less than three (3) weeks while in receipt or awaiting these benefits.

g. Leave granted under this clause may exceed the five (5) year maximum provided in paragraph (b) above only for the periods where the employee provides the Employer with proof that he or she is in receipt of or awaiting Employment Insurance (EI) Compassionate Care Benefits.

h. When notified, an employee who was awaiting benefits must provide the Employer with proof that the request for Employment Insurance (EI) Compassionate Care Benefits has been accepted.

i. When an employee is notified that their request for Employment Insurance (EI) Compassionate Care Benefits has been denied, paragraphs (f) and (g) above cease to apply.

(new)

17.19 Caregiving Leave

a. An employee who provides the Employer with proof that he or she is in receipt of or awaiting Employment Insurance (EI) benefits for Compassionate Care Benefits, Family Caregiver Benefits for Children and/or Family Caregiver Benefits for Adults may be granted leave without pay while in receipt of or awaiting these benefits.

b. The leave without pay described in 17.19(a) shall not exceed twenty-six (26) weeks for Compassionate Care Benefits, thirty-five (35) weeks for Family Caregiver Benefits for Children and fifteen (15) weeks for Family Caregiver Benefits for Adults, in addition to any applicable waiting period.

c. When notified, an employee who was awaiting benefits must provide the Employer with proof that the request for Employment Insurance (EI) Compassionate Care Benefits, Family Caregiver Benefits for Children and/or Family Caregiver Benefits for Adults has been accepted.

d. When an employee is notified that their request for Employment Insurance (EI) Compassionate Care Benefits, Family Caregiver Benefits for Children and/or Family Caregiver Benefits for Adults has been denied, clause 17.19(a) above ceases to apply.

e. Leave granted under this clause shall count for the calculation of “continuous employment” for the purpose of calculating severance pay and “service” for the purpose of calculating vacation leave. Time spent on such leave shall count for pay increment purposes.

(new)

CLAUSE 17.20

DOMESTIC VIOLENCE LEAVE

17.20 Domestic Violence Leave

For the purposes of this article domestic violence is considered to be any form of abuse or neglect that an employee or an employee’s child experiences from someone with whom the employee has or had an intimate relationship.

a. The parties recognize that employees may be subject to domestic violence in their personal life that could affect their attendance at work.

b. Upon request, an employee who is subject to domestic violence or who is the parent of a dependent child who is subject to domestic violence from someone with whom the employee has or had an intimate relationship shall be granted domestic violence leave in order to enable the employee, in respect of such violence:

· to seek care and/or support for themselves or their dependent child in respect of a physical or psychological injury or disability;

· to obtain services from an organization which provides services for individuals who are subject to domestic violence;

· to obtain professional counselling;

· to relocate temporarily or permanently; or

· to seek legal or law enforcement assistance or to prepare for or participate in any civil or criminal legal proceeding.

c. The total domestic violence leave with pay which may be granted under this article shall not exceed seventy-five (75) hours in a fiscal year.

d. The Employer may, in writing and no later than fifteen (15) days after an employee’s return to work, request the employee to provide documentation to support the reasons for the leave. The employee shall provide that documentation only if it is reasonably practicable for them to obtain and provide it.

e. Notwithstanding clauses 17.20(b) to 17.20(c), an employee is not entitled to domestic violence leave if the employee is charged with an offence related to that act or if it is probable, considering the circumstances, that the employee committed that act.

ARTICLE 25

UNION DUES

25.07 The Employer agrees to continue the past practice of making deductions for other purposes on the basis of the production of appropriate documentation.

ARTICLE 29

LEAVE FOR LABOUR RELATIONS MATTERS

29.11 Effective January 1, 2018, leave granted to an employee under Article 29.01(2), 29.05, 29.06, 29.08, and 29.09 will be with pay; the PIPSC will reimburse the employer for the salary and benefit costs of the employee during the period of approved leave with pay according to the terms established by joint agreement.

APPENDIX “E”

WORKFORCE ADJUSTMENT

**Specific sections to be amended are noted as follows**

References:

Federal Public Sector Service Labour Relations Act

Part VI: options for employees

6.2 Voluntary programs

The Voluntary Departure Program supports employees in leaving the public service when placed in affected status prior to entering a Selection of Employees for Retention or Layoff (SERLO) process, and does not apply if the deputy head can provide a guarantee of a reasonable job offer (GRJO) to affected employees in the work unit.

6.2.1 Departments and organizations shall establish internal voluntary departure programs for all workforce adjustment situations in which the workforce will be reduced and that involves involving five (5) or more affected employees working at the same group and level within the same work unit and where the deputy head cannot provide a guarantee of a reasonable job offer.

Part VII: special provisions regarding alternative delivery initiatives

7.2 General

7.2.2 (a)(ii) the Directive on Terms and Conditions of Employment, the terms of the collective agreement referred to therein and/or the applicable compensation plan will continue to apply to unrepresented and excluded employees until modified by the new employer or by the PSLREB FPSLREB pursuant to a successor rights application;

APPENDIX “J”

MEMORANDUM OF AGREEMENT WITH RESPECT TO

IMPLEMENTATION OF UNION LEAVE

This Memorandum is to give effect to an agreement reached between the Employer and the Professional Institute of the Public Service of Canada (the Union) to implement a system of cost recovery for leave for Union business.

The elements of the new system are as follows:

Recoverable paid leave for Union business for periods of up to 3 months of continuous leave per year;Cost recovery will be based on actual salary costs during the leave period, to which a percentage of salary, agreed to by the parties, will be added;The Employer will pay for all administration costs associated with the operation of this system.

The surcharge will be based on average expected costs incurred by the Employer for payroll taxes, pensions and supplementary benefits during the operation of the program as described above, calculated according to generally accepted practices.

Notwithstanding anything else in this agreement, and as an overarching principle, it will not include costs for benefits that would otherwise be paid by the Employer during an equivalent period of leave without pay. The consequences of the implementation of clause 29.11 will be cost neutral for the Employer in terms of compensation costs, and will confer neither a substantial financial benefit, nor a substantially increased cost, on the Employer.

A joint committee consisting of an equal number of Union and Employer representatives will be struck to resolve matters related to the implementation this new program, including, but not limited to, invoices, accounting and the manner of the transaction.

The Joint Committee’s principal work will relate to:

Determining an appropriate surcharge in recognition of the considerations identified in this document;Establishing processes and the Employer’s reporting requirements;

andOther considerations associated with implementation.

If agreement cannot be reached on recovering costs against Union remittances, the Joint Committee will consider alternate means of cost recovery.

The Joint Committee will be struck and convened within by February 15, 2017, and will complete its work by October 16, 2017, with implementation to be completed by the earliest feasible date as determined by the committee.

In the event that the parties do not reach an agreement, the parties may seek the services of a mediator. Necessary consequential changes will be made to Article 29, effective January 1, 2018.

The deadline for completion of work and implementation of this system may be extended by mutual consent of both parties to this agreement.

(new)

APPENDIX “J”

MEMORANDUM OF UNDERSTANDING BETWEEN THE TREASURY BOARD OF CANADA AND THE PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA IN RESPECT TO LEAVE FOR UNION BUSINESS: COST RECOVERY

This memorandum of understanding (MoU) is to give effect to an agreement reached between the Treasury Board (the Employer) and the Professional Institute of the Public Service of Canada (the Institute) to implement a system of cost recovery for leave for union business.

The parties agree to this MoU as a direct result of current Phoenix pay system implementation concerns related to the administration of leave without pay for union business.

Leave granted to an employee under the following clauses of the collective agreement:

- 29.01(2), 29.05,29.06, 29.08, 29.09

will be with pay for a total cumulative maximum period of three (3) months per fiscal year.

Its agreed that leave with pay granted under the above-noted clauses for union business will be paid for by the Employer, pursuant to this MoU, effective upon its signature.

The Institute shall then reimburse the Employer for the total salary paid, including allowances if applicable, for each person-day, in addition to which shall also be paid to the Employer by the Institute an amount equal to six percent (6%) of the total salary paid for each person-day, which sum represents the Employer’s contribution for the benefits the employee acquired at work during the period of approved leave with pay pursuant to this MoU.

Leave with pay in excess of the total cumulative maximum period of three (3) months per fiscal year may be granted under the above-noted clauses in reasonably limited circumstances. Where leave with pay is extended under such circumstances, the Institute shall reimburse the Employer for the total salary paid, including applicable allowances, for each person-day, in addition to an amount equal to thirteen decimal three percent (13.3%) of the total salary paid for each person-day.

Under no circumstances will leave with pay under the above-noted clause be granted for any single consecutive period exceeding three (3) months ; or for cumulative periods exceeding six (6) months in a twelve (12) months period.

This MoU does not alter the approval threshold for the leave. Should an employee be denied extended leave with pay exceeding three (3) cumulative months or a single consecutive three (3) month period within a fiscal year and the employee’s union leave is otherwise approved pursuant to the relevant clauses at article 29, they shall take the leave as leave without pay.

On a bimonthly basis, and within 120 days of the end of the relevant period of leave, the hiring department/agency will invoice the Institute for the amount owed to them by virtue of this understanding. The amount of the gross salaries and the number of days of leave taken for each employee will be included in the statement.

The Institute agrees to reimburse the department/agency for the invoice within sixty (60) days of the date of the invoice.

This memorandum of understanding expires on September 30, 2022, or upon implementation of the next-generation HR and pay system, whichever comes first, unless otherwise agreed by the parties.

APPENDIX “K”

MEMORANDUM OF AGREEMENT ON SUPPORTING EMPLOYEE WELLNESS

This Memorandum of Agreement is to give effect to the agreement reached between the Employer and the Professional Institute of the Public Service of Canada (hereinafter referred to as “the parties”) regarding issues of employee wellness.

The parties will create an Employee Wellness Support Program (EWSP) which will focus on improving employee wellness and the reintegration of employees into the workplace after periods of leave due to illness or injury.

Key features

The EWSP will incorporate the following key features:

contained in collective agreements;benefits for up to 26 weeks (130 working days) with income support replacement at 100%;the annual allotment shall be 9 days of paid sick leave for illness or injury that falls outside of the parameters of the EWSP;100% income replacement during the 3 day (working) qualification period when the employee’s claim is approved;qualifying chronic or episodic illnesses will be exempt of the waiting period;the qualification period will be waived in cases of hospitalization or recurrence of a prior illness or injury approved under EWSP within 30 days;employees are entitled to carry over a maximum of 3 days of unused sick leave credits remaining at the end of the fiscal year, for use in the following fiscal year;the accumulation of current sick leave credits will cease once the EWSP is implemented. Employees with banked sick leave in excess of 26 weeks, will be entitled to carry over those excess days to provide extended coverage at 100% income replacement prior to accessing LTD;travel time for diagnosis and treatment;internal case management and return to work services focused on supporting employees when ill or injured;an employee on EWSP will be considered to be on leave with pay;full costs of administering the EWSP to be borne by Employer;andincrease the quantum of family related leave by one (1) day.

Process

The parties agree to create a technical committee and a steering committee, with a long-term focus and commitment from senior leadership of the parties.

The steering committee and technical committee will be established within 60 days of signing. The committees will be comprised of an equal number of Employer representatives and Union representatives. The steering committee is responsible for determining the composition of the technical committee.

All time spent by employees in support of the Technical Committee shall be deemed to be leave with pay for Union activities. The Employer will grant leave with pay for employees engaged in these activities, including preparation and travel time.

The technical committee will develop all agreements and documents needed to support the implementation of an EWSP during the next round of collective bargaining. This work shall be completed within one year of signing. The technical committee shall provide interim recommendations for review by the steering committee on the following matters through a series of regular meetings:

consequential changes to existing leave provisions within the collective agreements, and the Long Term Disability Plan (LTD);definitions;eligibility conditions for a new EWSP;assessment and adjudication processes;internal case management and return to work services;workplace accommodations;creation of a Centre for Workplace Well-Being;governance of the EWSP, including dispute resolution mechanisms;coverage of operational stress injuries and other injuries sustained by employees deployed in military operations;harassment;domestic violence;andother measures that would support an integrated approach to the management of health for federal public service employees.

The technical committee shall review practices from other Canadian jurisdictions and employers that might be instructive for the public service, recognizing that not all workplaces are the same. Federal public service health and safety committees will be consulted as required by the steering committee, as well as leading Canadian experts in the health and disability management field.

The steering committee is to approve a work plan for the technical committee and timelines for interim reports within 4 months of signing. The technical committee work plan may be amended from time to time by mutual consent of the steering committee members.

Dates may be extended by mutual agreement of the steering committee members. The technical committee terms of reference may be amended from time to time by mutual consent of the steering committee members.

The parties agree if an agreement is not reached within 18 months from the establishment of the Technical Committee, or at any time before that time, to jointly appoint a mediator within 30 days.

Integration into collective agreements

Once the parties reach agreement on tentative EWSP language and program design, that agreement will be provided to individual PIPSC bargaining tables for ratification and inclusion in their collective agreements.The agreement reached on the EWSP shall not be altered by any bargaining tables.Future amendments to the EWSP shall require the agreement of the Institute and the Employer. Future amendments shall be negotiated between the parties at a central table made up of an Institute bargaining team and an Employer bargaining team.

Annex

The parties agree that the following subject areas shall be discussed by the Technical Committee, including but not limited to:

a. income support during appeal process;

b. updates and changes to the Long Term Disability Plan;

c. medical appointments;

d. treatment plans;

e. enhanced treatment coverage;

f. negative sick leave banks;

g. utility for sick leave banks;

h. disability management office;

i. transitional provisions such as employees on sick leave at date of transition;

j. additional sick leave days for health care professionals;

k. allotment of sick leave days (earned vs. annual advance);

l. services provided by the Centre for Workplace Well-Being;

m. privacy considerations;

n. definition of chronic and episodic illnesses;

o. shift workers.

(revised)

APPENDIX “K”

MEMORANDUM OF AGREEMENT ON SUPPORTING EMPLOYEE WELLNESS

This memorandum of agreement is to give effect to the agreement reached between the Employer and the bargaining agent (hereinafter referred to as “the parties”) regarding issues of employee wellness. This MOA replaces the prior Employee Wellness MOA previously signed.

The parties have engaged in meaningful negotiations and co-development of comprehensive EWSP language and program design to capture the key features and other recommendations agreed to by the technical committee and steering committee, which is reflected in the Plan Document agreed to by the parties on May 26, 2019.

The program and its principles focus on improving employee wellness and the reintegration of employees into the workplace after periods of leave due to illness or injury. The previous MOA identified the following key features:

- contained in collective agreements;

- benefits for up to twenty-six (26) weeks (one hundred and thirty (130) working days) with income support replacement at one hundred per cent (100%);

- the annual allotment shall be nine (9) days of paid sick leave for illness or injury that falls outside of the parameters of the EWSP;

- one hundred per cent (100%) income replacement during the three (3) day (working) qualification period when the employee’s claim is approved;

- qualifying chronic or episodic illnesses will be exempt of the waiting period;

- the qualification period will be waived in cases of hospitalization or recurrence of a prior illness or injury approved under EWSP within thirty (30) days;

- employees are entitled to carry over a maximum of three (3) days of unused sick leave credits remaining at the end of the fiscal year, for use in the following fiscal year;

- the accumulation of current sick leave credits will cease once the EWSP is implemented. Employees with banked sick leave in excess of twenty-six (26) weeks, will be entitled to carry over those excess days to provide extended coverage at one hundred per cent (100%) income replacement prior to accessing LTD;

- travel time for diagnosis and treatment;

- internal case management and return-to-work services focused on supporting employees when ill or injured;

- an employee on EWSP will be considered to be on leave with pay;

- full costs of administering the EWSP to be borne by Employer; and

- increase the quantum of family related leave by one (1) day.

The Plan Document approved on May 26, 2019, takes precedence over the principles if there’s a difference in interpretation.

Process

The parties agree to continue the work of the TBS / Bargaining Agent Employee Wellness Support Program (EWSP) Steering Committee, which will focus on finalizing a service delivery model for program implementation, including its governance, for the improvement of employee wellness and the reintegration of employees into the workplace after periods of leave due to illness or injury.

As required, the Steering Committee will direct a subcommittee to make recommendations on the overall implementation, service delivery and governance issues of the Program. As a first priority, the Steering Committee will develop a planning framework with timelines to guide work toward the timely implementation of the new EWSP. A governance model will be developed taking into account there will be only one (1) EWSP.

The Steering Committee will complete the necessary work on overall implementation, including service delivery and governance issues no later than March 21, 2020, a date which can be moved based on mutual agreement of the parties.

If accepted by the Steering Committee, the recommendation(s) concerning program implementation, including service delivery and governance, as well as the proposal for the EWSP itself, approval will be sought on these elements from the Treasury Board of Canada and by the bargaining units.

If approved by both parties, the parties mutually consent to reopen the collective agreement to vary the agreement only insofar as to include the EWSP wording, and include consequential changes. No further items are to be varied through this reopener – the sole purpose will be EWSP-related modifications. The EWSP Program would be included in the relevant collective agreements only as a reopener.

Should the parties not be able to reach agreement on EWSP, the existing sick leave provisions, as currently stipulated in collective agreements, will remain in force.

For greater certainty, this MoA forms part of the collective agreement.

(new)

APPENDIX “VV”

MEMORANDUM OF AGREEMENT BETWEEN THE TREASURY BOARD OF CANADA AND THE PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA WITH RESPECT TO CERTAIN TERMS AND CONDITIONS OF EMPLOYMENT FOR DEEMED

ROYAL CANADIAN MOUNTED POLICE CIVILIAN MEMBERS

General

This memorandum is to give effect to the agreement reached between the Employer and the Professional Institute of the Public Service of Canada (the Institute) on certain terms and conditions of employment applicable to employees that were Royal Canadian Mounted Police (RCMP) Civilian Members on the day immediately preceding the date on which they were deemed to be persons appointed under the Public Service Employment Act as per the date published in the Canada Gazette (date of deeming).

The parties agree that the terms and conditions of employment applicable to RCMP civilian members will remain in effect until the earlier of the date of deeming or until a date mutually agreed to by the parties. The provisions of the collective agreement and this memorandum of agreement will apply to civilian members thereafter. For greater clarity, paragraphs 3(a). to (c). of the “Memorandum of Understanding between the Treasury Board and the Bargaining Agents with Respect to Implementation of the Collective Agreement” as agreed to by the Institute and Treasury Board do not apply to civilian members.

Upon written request of the Institute, the Employer agrees to incorporate into this agreement any civilian member transition measures, negotiated with any other bargaining agents between now and the date of deeming, that are more generous than those contained in this agreement.

Any amendments to this agreement shall require the written agreement of the Institute and the Employer.

Notwithstanding the applicability of the general provisions of this collective agreement, the following specific provisions also shall apply to deemed civilian members (thereafter former civilian members).

Eligibility

The transition measures contained in this agreement will continue for as long as the former civilian member remains within a bargaining unit represented by the Institute, either:

a) within the RCMP;

b) for those civilian members that will become Shared Services Canada (SSC) employees at the time of deeming, for as long as they remain within SSC or the RCMP.

Existing leave credits

The Employer agrees to accept any unused, earned leave banks of a former civilian member to which he or she was entitled to on the day immediately prior to the date of deeming (including vacation leave credits, lieu time, operational response, and isolated post credits).

For greater clarity, existing leave banks will not be pro-rated to reflect the change from a forty (40) hour workweek to a thirty-seven decimal five (37.5) hour workweek.

Vacation leave

Accumulation of vacation leave credits

The Employer agrees to maintain the vacation leave credit accrual entitlement that is in effect on the day immediately prior to the date of deeming. The former civilian member will maintain his or her vacation leave entitlement until the next anniversary of service threshold, provided that the vacation leave credit accrual schedule contained in this collective agreement is equal to or greater than their corresponding leave entitlement.

For greater clarity, the vacation accrual rate post deeming will be pro-rated to reflect the change from a 40 hour workweek to a 37.5 hour workweek in accordance with the following table:

Conversion table

|

Vacation leave accrual rate prior to deeming (i.e., forty (40) hour workweek (CM)) |

Vacation leave accrual rate post deeming (i.e., thirty-seven decimal five (37.5) hour workweek (PSE)) |

|

10 |

9.375 |

|

13.33 |

12.5 |

|

16.66 |

15.625 |

|

20 |

18.75 |

Vacation leave adjustment

Former civilian members will be granted forty (40) hours of vacation leave credits and these credits will not be subject to the carry-over provisions of the applicable collective agreement.

Former civilian members are subject to all other provisions outlined in the vacation leave article of the relevant collective agreement.

Sick leave

Granting of sick leave credits

In recognition of the civilian members’ transition from an unrestricted sick leave regime to a sick leave bank regime, upon the date of deeming, former civilian members shall be granted a bank of sick leave credits that is the greater of six decimal two five (6.25) hours for each completed calendar month of service or four hundred and eighty-seven decimal five (487.5) hours of sick leave credits.

Pay increment

The anniversary date for the purpose of pay increment will be the date on which the former civilian member received her or his last pay increment.

Relocation on retirement benefit

Upon the date of deeming, former civilian members who were relocated at the Crown’s expense will be eligible for a retirement relocation. Claims for reimbursement of relocation expenses shall be paid in accordance with the Treasury Board Secretariat of Canada (TBS) approved RCMP Relocation Policy that is in effect at the time the former civilian member retires from the core public administration. The Employer also agrees to consult with the Institute about any contemplated changes to this policy.

Funeral and burial entitlements

Former civilian members shall remain eligible for funeral and burial entitlements in accordance with the RCMP’s Death Benefits, Funeral and Burial Entitlements Policy that is in effect at the time the benefits are applied for. The Employer also agrees to consult with the Institute about any contemplated changes to this policy.

Upon their retirement, these entitlements will continue until their death.

Signed at Ottawa this XXth day of the month of XX 2020.

(new)

APPENDIX “WW”

MEMORANDUM OF UNDERSTANDING BETWEEN THE TREASURY BOARD OF CANADA AND THE PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA WITH RESPECT TO

IMPLEMENTATION OF THE COLLECTIVE AGREEMENT

Notwithstanding the provisions of clause 47.03 on the calculation of retroactive payments and clause 49.03 on the collective agreement implementation period, this memorandum is to give effect to the understanding reached between the Employer and the Professional Institute of the Public Service of Canada regarding a modified approach to the calculation and administration of retroactive payments for the current round of negotiations.

1. Calculation of retroactive payments

a. Retroactive calculations that determine amounts payable to employees for a retroactive period shall be made based on all transactions that have been entered into the pay system up to the date on which the historical salary records for the retroactive period are retrieved for the calculation of the retroactive payment.

b. Retroactive amounts will be calculated by applying the relevant percentage increases indicated in the collective agreement rather than based on pay tables in agreement annexes. The value of the retroactive payment will differ from that calculated using the traditional approach, as no rounding will be applied. The payment of retroactive amount will not affect pension entitlements or contributions relative to previous methods, except in respect of the rounding differences.

c. Elements of salary traditionally included in the calculation of retroactivity will continue to be included in the retroactive payment calculation and administration, and will maintain their pensionable status as applicable. The elements of salary included in the historical salary records and therefore included in the calculation of retroactivity include:

- salary

- promotions

- deployments

- acting pay

- extra duty pay/Overtime

- additional hours worked

- maternity leave allowance

- parental leave allowance

- vacation leave and extra duty pay cash-out

- severance pay

- salary for the month of death

- transition Support Measure

- eligible allowances and supplemental salary depending on collective agreement

d. The payment of retroactive amounts related to transactions that have not been entered in the pay system as of the date when the historical salary records are retrieved, such as acting pay, promotions, overtime and/or deployments, will not be considered in determining whether an agreement has been implemented.

e. Any outstanding pay transactions will be processed once they are entered into the pay system and any retroactive payment from the collective agreement will be issued to impacted employees.

2. Implementation

a. The effective dates for economic increases will be specified in the agreement. Other provisions of the collective agreement will be effective as follows:

i. All components of the agreement unrelated to pay administration will come into force on signature of agreement.

ii. Changes to existing compensation elements such as premiums, allowances, insurance premiums and coverage and changes to overtime rates will become effective within one hundred and eighty (180) days after signature of agreement, on the date at which prospective elements of compensation increases will be implemented under subparagraph 2(b)(i).

iii. Payment of premiums, allowances, insurance premiums and coverage and overtime rates in the collective agreement will continue to be paid until changes come into force as stipulated in subparagraph 2(a)(ii).

b. Collective agreements will be implemented over the following time frames:

i. The prospective elements of compensation increases (such as prospective salary rate changes and other compensation elements such as premiums, allowances, changes to overtime rates) will be implemented within one hundred and eighty (180) days after signature of agreement where there is no need for manual intervention.

ii. Retroactive amounts payable to employees will be implemented within one hundred and eighty (180) days after signature of the agreement where there is no need for manual intervention.

iii. Prospective compensation increases and retroactive amounts that require manual processing by compensation advisors will be implemented within five hundred and sixty (560) days after signature of agreement. Manual intervention is generally required for employees on an extended period of leave without pay (e.g., maternity/parental leave), salary-protected employees and those with transactions such as leave with income averaging, pre-retirement transition leave and employees paid below minimum, above maximum or in between steps. Manual intervention may also be required for specific accounts with complex salary history.

3. Employee recourse

a. An employee who is in the bargaining unit for all or part of the period between the first day of the collective agreement (i.e., the day after the expiry of the previous collective agreement) and the signature date of the collective agreement will be entitled to a non-pensionable amount of five hundred dollars ($500) payable within one hundred and eighty (180) days of signature, in recognition of extended implementation time frames and the significant number of transactions that have not been entered in the pay system as of the date when the historical salary records are retrieved.

b. Employees in the bargaining unit for whom the collective agreement is not implemented within one hundred and eighty-one (181) days after signature will be entitled to a fifty-dollar ($50) non-pensionable amount; these employees will be entitled to an additional fifty-dollar ($50) non-pensionable amount for every subsequent complete period of ninety (90) days their collective agreement is not implemented. These amounts will be included in their final retroactive payment.

c. If an employee is eligible for compensation in respect of section 3 under more than one collective agreement, the following applies: the employee shall receive only one non-pensionable amount of five hundred dollars ($500); for any period under paragraph 3(b), the employee may receive one fifty-dollar ($50) payment.

d. Should the Employer negotiate higher amounts for paragraphs 3(a) or 3(b) with any other bargaining agent representing core public administration employees, it will compensate PIPSC members for the difference in an administratively feasible manner.

e. Late implementation of the 2018 collective agreements will not create any entitlements pursuant to the agreement between the core public administration bargaining agents and the Treasury Board of Canada with regard to damages caused by the Phoenix pay system.

f. Employees for whom collective agreement implementation requires manual intervention will be notified of the delay within one hundred and eighty (180) days after signature of the agreement.

g. Employees will be provided a detailed breakdown of the retroactive payments received and may request that the departmental compensation unit or the Public Service Pay Centre verify the calculation of their retroactive payments, where they believe these amounts are incorrect. The Employer will consult with the Institute regarding the format of the detailed breakdown.

h. In such a circumstance, for employees in organizations serviced by the Pay Centre, they must first complete a Phoenix feedback form indicating what period they believe is missing from their pay.

(new)

APPENDIX “XX”

MEMORANDUM OF UNDERSTANDING BETWEEN THE TREASURY BOARD OF CANADA AND THE PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA WITH RESPECT TO GENDER INCLUSIVE LANGUAGE

This memorandum is to give effect to the agreement reached between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada regarding the review of language in the AV, CS, NR, RE, SH and SP collective agreements.

Both parties are committed to and support gender neutrality and inclusivity. To that end, the parties commit to, during the life of the above-noted collective agreements, establishing a Joint Committee to review the collective agreements to identify opportunities to render the language more gender-inclusive. The parties agree that any changes in language will not result in changes in application, scope or value.

Both parties acknowledge that gender inclusivity is more difficult to achieve in the French language compared to the English language, but are committed nonetheless to further supporting and increasing gender neutrality and inclusivity in the collective agreement.

The Joint Committee agrees to begin their work in 2020 and will endeavour to finalize the review by December 2021. These timelines may be extended by mutual agreement.

(new)

APPENDIX “YY”

MEMORANDUM OF UNDERSTANDING BETWEEN THE TREASURY BOARD OF CANADA AND THE PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA WITH RESPECT TO WORKPLACE HARASSMENT

This memorandum is to give effect to the agreement reached between the Treasury Board and the Professional Institute of the Public Service of Canada (the Institute).

Both parties share the objective of creating healthy work environments that are free from harassment and violence. In the context of the passage of Bill C-65, An Act to amend the Canada Labour Code by the Government of Canada, as well as the Clerk of the Privy Council’s initiative to take action to eliminate workplace harassment, the Treasury Board is developing a new directive covering both harassment and violence situations.

During this process, the Treasury Board will consult with the members of National Joint Council (NJC) on the following:

- mechanisms to guide and support employees through the harassment resolution process;

- redress for the detrimental impacts on an employee resulting from an incident of harassment;

and - ensuring that employees can report harassment without fear of reprisal.

Should the Institute request, the Employer would, in addition to the NJC consultations, agree to bilateral discussions with the Institute. Following such discussions, a report will be provided to the NJC.

The implementation and application of this directive do not fall within the purview of this MOU or the collective agreement.

This memorandum expires upon issuance of the new directive or December 21, 2021, whichever comes first.

(new)

APPENDIX “ZZ”

MEMORANDUM OF UNDERSTANDING BETWEEN THE TREASURY BOARD OF CANADA AND THE PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA WITH RESPECT TO THE COMMON PAY ADMINISTRATION

This memorandum is to give effect to an agreement reached between the Employer and the Professional Institute of the Public Service of Canada (the Institute) regarding consultation on the development of the next-generation Human Resources (HR) and pay system.

Both parties recognize the challenges of the Phoenix pay system. A Joint Union-Management Consultation Committee on next-generation HR and pay system has been established to advance the mutual goal of discussing and identifying opportunities and considerations for a potential next-generation HR and pay system that meets the legitimate needs of the Employer and the employees.

This memorandum will confirm the Employer’s commitment to continue consultation with the Institute on the next-generation HR and pay at the Joint Union-Management Committee with respect to the development of a next-generation HR and pay system.

This memorandum of understanding expires on December 21, 2021.

ANNEX B

RATES OF PAY

| December 22, 2018 – increase to rates of pay: | 2.0% Economic Increase + 0.8% Wage Adjustment |

| December 22, 2019 – increase to rates of pay: | 2.0% Economic Increase + 0.2% Wage Adjustment |

| December 22, 2020 – increase to rates of pay: | 1.5% Economic Increase |

The Employer proposes to implement increases in accordance with the new Appendix “WW” - Memorandum of Understanding between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada with respect to Implementation of the Collective Agreement.

Amounts in respect of the period prior to the implementation date will be paid as a retroactive payment, in accordance with the new Appendix “WW” – Memorandum of Understanding between the Treasury Board of Canada and the Professional Institute of the Public Service of Canada with respect to Implementation of the Collective Agreement. Subsequently, amounts will be provided as increases to rates of pay.

ANNEX C

ARTICLE 49

DURATION

49.01 The duration of this collective agreement shall be from the date it is signed to December 21, 201821.

ANNEX D

CLAUSE 17.02

OTHER LEAVE WITH OR WITHOUT PAY

17.02 Bereavement leave with pay

For the purpose of this clause, immediate family is defined as father, mother, (or alternatively stepfather, stepmother or foster parent) brother, sister, step-brother, step-sister, spouse (including common-law partner residing with the employee), child (including child of common-law partner) stepchild, foster child or ward of the employee, grandparent, grandchild, father-in-law, mother-in-law, and relative permanently residing in the employee’s household or with whom the employee permanently resides., or, subject to paragraph 17.02 e) below, a person who stands in the place of a relative for the employee whether or not there is any degree of consanguinity between such person and the employee.

[…]

(new paragraph)

e. An employee shall be entitled to bereavement leave with pay for a person who stands in the place of a relative for the employee whether or not there is a degree of consanguinity between such person and the employee only once in their career in the federal public administration.

Agreed to in principle by the parties on October 28, 2020.CLAUSE 17.09

LEAVE WITHOUT PAY FOR THE CARE OF IMMEDIATE FAMILY

17.09 Leave without pay for the care of immediate family

a. For the purpose of this clause, immediate family is defined as spouse (or common-law partner resident with the employee), children (including step-children, foster children, ward of the employee or children of spouse or common-law partner) parents (including step-parents or foster parent), brother, sister, step-brother, step-sister, grandchild, grandparent of the employee, father-in-law, mother-in-law,or any relative permanently residing in the employee’s household or with whom the employee permanently resides., or a person who stands in the place of a relative for the employee whether or not there is any degree of consanguinity between such person and the employee.

Agreed to in principle by the parties on October 28, 2020.

CLAUSE 17.12

LEAVE WITH PAY FOR FAMILY-RELATED RESPONSIBILITIES

a. For the purpose of this clause, family is defined as spouse (or common-law partner resident with the employee); children (including foster children, step-children or children of spouse or common-law partner and ward of the employee); grandchild; parents (including step-parents or foster parents), father-in-law, mother-in-law; brother, sister, step-brother, step-sister; grandparents of the employee; any relative permanently residing in the employee’s household or with whom the employee permanently resides,; or any relative for whom the employee has a duty of care, irrespective of whether they reside with the employee., or a person who stands in the place of a relative for the employee whether or not there is any degree of consanguinity between such person and the employee.

Agreed to in principle by the parties on October 29, 2020.

APPENDIX “F”

MEMORANDUM OF UNDERSTANDING BETWEEN THE TREASURY BOARD OF CANADA AND THE PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA WITH RESPECT TO OCCUPATIONAL GROUP STRUCTURE REVIEW AND CLASSIFICATION REFORM

Meaningful consultation on Classification Reform will include consultation on the development of a standard which reflects and measures, in a gender-neutral manner, elements including skill, effort, responsibility, and working conditions of work performed by CS employees.

The review of the CS group falls within the broader context of the Occupational Group Structure (OGS) Review. Consultation and work on the CS occupational group review, including developing an implementation strategy, will be completed by December 2019. As the job evaluation standard has been completed, the development of an implementation strategy will continue, in consultation with the bargaining agent.

The agreement cannot be interpreted as a relinquishment of management rights over classification or as a guarantee that a consensus can be reached on any of the outcomes of the consultation themselves.

Effective on the conversion date and implementation of the Information Technology (IT) group, all references to the Computer Systems and CS in the collective agreement will be replaced to Information Technology and IT.

Agreed to in principle by the parties on October 28, 2020.

APPENDIX “I”

MEMORANDUM OF AGREEMENT BETWEEN THE TREASURY BOARD AND THE PROFESSIONAL INSTITUTE OF THE PUBLIC SERVICE OF CANADA WITH RESPECT TO CONTRACTING OUT

This Memorandum of Agreement (MOA) is to give effect to the understanding reached between the Treasury Board and the Professional Institute of the Public Service of Canada (PIPSC) regarding the procurement contracting of duties that are performed by employees in the Computer Systems (CS) Bargaining Unit as described in the Bargaining Certificate and the Group Definition.

By way of this Memorandum of Agreement, Shared Services Canada, Department of National Defence, and Employment and Social Development Canada will, in consultation with PIPSC local representatives develop by December 2017 2021, departmental guidelines on the contracting of duties that are performed by employees in the CS Bargaining Unit (as described in the Bargaining Certificate and the Group Definition). The implementation of the respective departmental guidelines does not fall within the purview of this Memorandum of Agreement.

In developing the guidelines, the named departments shall take into consideration the following principles of responsible procurement contracting (consistent with the Treasury Board Policy on Contracting):

- Appropriate approvals must be obtained prior to entering into contracts;

- Statements of work must clearly describe the work to be carried out, the objectives to be attained and the time frame;

- Avoid excessive or improper contracting services that could result in circumvention of government legislation, regulations and policies covering such matters as the merit principle and bilingualism;

- Avoid contracting situations that would be contrary to or conflict with the PSEA and legal principles dealing with Employer-Employee relationships;

- Control frameworks for due diligence and effective stewardship of public funds are in place and working;

and - Contracts should not be amended unless such amendments are in the best interest of the government, because they save dollars or time, or because they facilitate the attainment of the primary objective of the contract.

At a minimum, the named departments shall develop guidelines on the following:

- Notification /consultation on departmental plans that directly affect CS employment levels, including reporting on contracting expenditures;

- Notification/consultation, as part of internal planning processes and prior to approval of major contracts;

- Establish mechanisms such as a departmental skills inventory to facilitate employee mobility and learning and development opportunities that promote workforce agility;

- Avoidance of Employer-Employee relationships for contractors;

and - Proper application of the PIPSC Work Force Adjustment provisions (Appendix E of the CS collective agreement).

Notwithstanding the above, the parties recognize that Deputy Heads have full and final authority for departmental contracts and that Ministers are ultimately responsible to Parliament for all contracting activity.

The parties recognize that nothing in this Memorandum of Agreement shall be construed as affecting the right or authority of the Employer to:

- Organize the federal public administration or any portion thereof, and determine and control establishments;

- Assign duties to and to classify positions and persons employed in the federal public administration;

- or

- Amend the Treasury Board Policy on Contracting at any time.

As such, the named departments can amend their respective guidelines at any time to ensure, among other things, alignment with the Treasury Board Policy on Contracting.

All time spent by employees attending meetings with management on Government Procurement Contracting in support of developing the guidelines shall be deemed to be on leave with pay.

Agreed to in principle by the parties on October 28, 2020.